|

| Banknotes from the New Design Series | © Qvist / Shutterstock |

Let's face it. We Filipinos love to spend what money we have on things that we really don't need.

It's that time of the month again, and you can see many Filipinos dressed up elegantly. Branded Shoes, Bags, Watches, Clothes, and expensive gadgets. it clearly shows that we Filipinos have a penchant for the best life has to offer. Splurging on salary day is very common for many expatriates, especially those based here in the middle east. Where everything seems a lot cheaper compared back home.

|

| Image credit: Shutterstock |

So when the end of the contract approaches we end up scratching our heads. asking, why we didn't have enough money saved to go home and not to continue or extend our contracts. A lot of Filipinos refer to this as "Sumpa ng Desierto" but this is more of a psychological metaphor than an actual fact. This kind of behavior is deeply rooted within us expatriate Filipinos because we grew up not having a lot in life. Later on, having experienced abundance by working here in the middle east essentially gave us a lot of growth opportunities.

So, why do we fail? It is the Financial Discipline that we never bothered to inculcate in our minds and the Financial Education that we really need to be successful in these ever-changing times.

Before we go any further. Let us ask ourselves, What is our end goal? What should be accomplished? What should I be striving for?

Wealth? Riches? Travel? House? Car? and the list goes on....

Given some of us will answer a lot of the above, we fail to come to terms with the number one goal we need to strive for, and that is.

Why you ask? Because Time is the only valuable resource that we cannot reproduce. That is why as early as now we need to come to a realization that we cannot work and stay for a very long time in a foreign land without having any form of savings or investments.

With that realization having some kind of money, earning passively can be a powerful tool in beating "inflation". One form of passive income I've come across recently is Ginvest by Gcash.

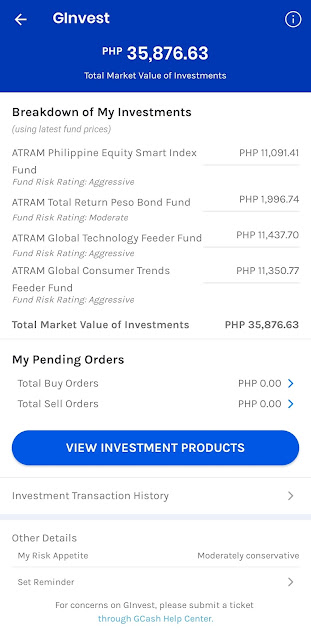

What is GInvest? GInvest is the investment marketplace feature of the GCash App. This service allows users to invest in various investment funds from their product partners. meaning anyone with a globe sim and Gcash app can start investing for as little as 50php for local funds and 1000php for international funds. If you want to learn more about what this investment platform can offer. watch this video.

I started "Investing" two months ago when I came across a video on youtube about investing and ways you can earn passively. This has been a journey for me. learning, exploring, and educating myself financially. So far I can say I am very satisfied with this platform because it made it so easy to get into investing without the cumbersome process of going to the bank, investment company, or a broker and then filling out all the necessary papers not to mention all the requirements needed. The best part about using this platform is it's very cheap and easy.

As you can see from the image above, I started investing in different funds until I reached a capital balance of 35,000php (i am investing and diversifying my funds regularly every month) with a paper gain or indefinite profit of 876.63php within 2 months.

876.63php profit is no joke. Rather than keeping your money in the bank earning a mediocre less than 1% interest, why not invest and let it earn profit over time. Remember this is not a get-rich-quick and instant profit scheme. This, as with any other investment takes time to see actual returns. The key is PATIENCE AND PERSEVERANCE.

Your goal here is to accumulate interest over a long period of time by what the financial people call

"Compounding Interest" This will prepare you for your future retirement.

"IWAN MO LANG AT HAYAAN MONG LUMAGO ANG IYONG KAPITAL"

But be warned "Investing" is not for the faint of heart. There is a very real and high risk involved. If you are the emotional type, I suggest to please study first before entering this type of income-generating scheme.

All of what I talked about here seems very confusing for those who aren't familiar with this topic. but remember your goal and study first before diving in with your very first investment.

Here are some very helpful links to get you started:

1. How to create a

Gcash Account.

Helpful Tips:

1. Invest regularly and consistently even if the market is down or in shambles. (Babawi din ang market because it's a cycle).

2. Don't be too quick to sell ( This is not like Day trading stocks) it doesn't work that way. LONG TERM ANG GOAL MO! remember Ginvest has fund managers, they will take care of the funds.

3. Remember to set aside a portion of your income or salary every month.

The information you achieve will almost definitely turn out to be useful when your own cash is on the line. With that in mind, you will undoubtedly need to claim the 100% deposit match bonus as much as} $1,500 too, which is granted after you make your first deposit. Some websites will automatically award you a bonus upon your first deposit, but an operator will always allow you to decline 바카라사이트 the provide afterwards. Many gamers select to ignore promotional offers if they are a excessive wagering bonus. Validity revers to the period of time one has to fulfil the specific wagering requirements established in a casino bonus offer’s T&Cs.

ReplyDelete